Luxury Hotel Market Size, Share & Trends Analysis Report By Category (Chain, Independent), By Type (Business Hotels, Airport Hotels, Holiday Hotels, Resorts & Spa), By Booking Mode, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-2-68038-139-9

- Number of Report Pages: 110

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

Luxury Hotel Market Size & Trends

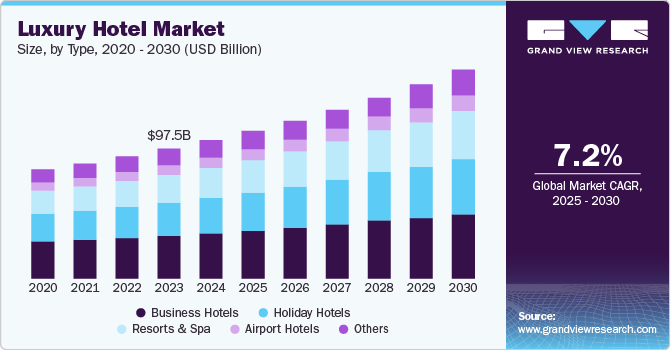

The global luxury hotel market size was estimated at USD 103.93 billion in 2024 and is projected to grow at a CAGR of 7.2% from 2025 to 2030. The luxury hotel industry is experiencing significant growth, with the number of global luxury rooms projected to rise from 1.6 million in 2023 to 1.9 million by 2030, as per CoStar. This expansion is fueled by rising demand from affluent travelers and aspirational middle-class consumers seeking unique experiences for special occasions like birthdays and destination weddings. Business travel is another driver for market growth, with corporate retreats becoming popular among mid-level and senior managers.

Diversification of luxury destinations, such as Maldives, attracting families and groups, has further supported higher occupancy rates and lengthened average stays, which reached 7.6 days in 2023.

Specialized operators and luxury hotel brands are propelling the luxury hotel industry forward. Notably, Six Senses has seen an annual growth of over 14% since 2005, while Aman Hotels has achieved a 5% annual growth in the same period, reaching nearly 1,400 rooms in 2024. Smaller firms like Virgin Limited Edition and Soneva have also recorded steady growth. High profitability attracts investors, with returns exceeding 6% in 2022, according to JLL. Examples include Saudi Arabia’s PIF investing USD 1.8 billion in Rocco Forte and over USD 1 billion in Aman Group, demonstrating the lucrative appeal of the luxury hospitality industry.

Shifts in consumer preferences are reshaping the luxury hotel industry. Guests increasingly prioritize unique experiences over opulent formality, driving luxury hotels to offer cultural immersion, personalized services, and exclusivity. For instance, Soneva Secret in the Maldives features private villas, stargazing roofs, and dedicated staff for each guest. This aligns with a broader trend of integrating local traditions and curating unforgettable experiences. Partnerships with luxury brands, such as Four Seasons’ collaboration for lending high-end accessories, further highlight innovative efforts in the luxury hospitality industry.

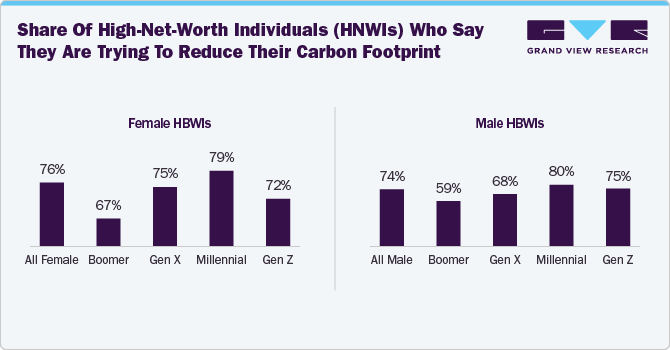

Sustainability is becoming a hallmark of the luxury hotel industry. Many properties focus on eco-friendly practices, such as using renewable energy, recycling materials, and supporting local communities. Soneva Fushi in the Maldives leverages solar power and waste recycling, while 1 Hotel Central Park integrates reclaimed wood and eco-conscious designs. Sustainable tourism offerings at hotels like Six Senses Southern Dunes and Lefay Resort underscore the growing demand for eco-luxury experiences. This balance between elegance and responsibility positions the hospitality industry for continued growth amidst evolving consumer expectations.

Consumer Insights & Surveys

The above data from the Knight Frank 2024 report shows a share of High-net-worth individuals (HNWIs) who say they are trying to reduce their carbon footprint. High-net-worth individuals (HNWIs) are increasingly prioritizing sustainability in luxury hotels, seeking accommodations that align with their values of environmental stewardship and cultural preservation. In response, brands like Six Senses, Four Seasons, and Soneva Fushi are integrating eco-friendly practices, such as renewable energy, waste management, and locally sourced dining, to meet these demands. Sustainable luxury hotels offer guests unique experiences that not only provide indulgence but also contribute to environmental preservation with initiatives like regenerative tourism and responsible construction. This blend of elegance and responsibility appeals to HNWIs who value both luxury and sustainability.

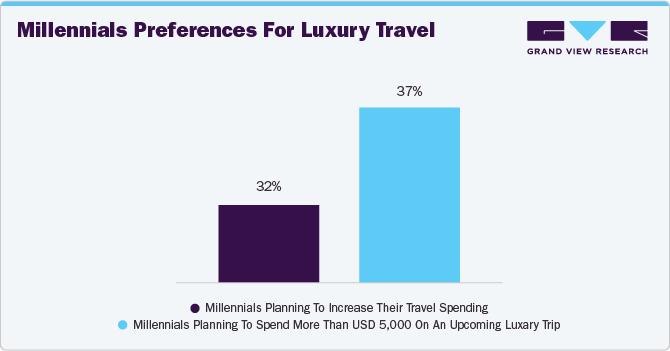

A 2021 TripAdvisor survey revealed that millennials are leading the recovery of U.S. traveler confidence in luxury travel. While nearly 60% of travelers across all age groups cited cost as a key factor when booking their next trip, only 40% of high-income millennials expressed similar concerns.

Category Insights

Luxury hotel chains accounted for a revenue share of about 65% of the market in 2024. Luxury hotel chains dominate the market due to their ability to adapt to regional nuances and create tailored strategies. Hilton, for instance, uses a hub-and-spoke model in emerging markets, establishing flagship brands and local infrastructure before expanding. This localization includes adapting to cultural needs, such as designing flexible wedding spaces in India for its Signia brand. In addition, in regions like Asia Pacific, family-driven investments for legacy purposes further strengthen their presence. At the same time, in the West, commercial real estate strategies drive growth, highlighting their versatility and global appeal.

The independent luxury hotel segment is expected to grow at a CAGR of 8.3% from 2025 to 2030. The segment is poised for growth due to its ability to offer personalized services, unique design, and authentic local experiences that resonate with travelers seeking individuality. Independent hotels excel in creating bespoke stays with a strong sense of place and cultural integration, while boutique hotels captivate guests with immersive experiences and distinct aesthetics. In addition, the rise of soft branding by major chains like Marriott and Hilton, through collections such as Autograph and Curio, supports independent hotels by blending their charm with global brand benefits, amplifying their appeal to a broader audience.

Type Insights

Business hotels held a market revenue share of about 32% in 2024. This segment thrives due to the demand for exclusive accommodations that seamlessly blend opulence with functionality. High-profile business travelers value amenities like private entrances, security features, spacious offices, and boardrooms tailored for discretion and efficiency. In addition, offerings such as Michelin-starred dining and iconic views enhance the appeal of these hotels, making them a preferred choice for executives seeking luxury and professionalism.

Demand for luxury resorts and spas is projected to increase at a CAGR of 8.3% from 2025 to 2030. Luxury resorts and spas are poised for significant growth as affluent travelers seek immersive, holistic wellness experiences. Brands like SHA Wellness Clinic, Six Senses Douro Valley, and Amangiri are leading the trend by offering tailored health treatments, mental wellness programs, and sustainable luxury. Post-pandemic revenge travel has accelerated demand for longer, restorative stays, with wellness tourism projected to increase dramatically. Features like cryotherapy, sound healing, and eco-luxury appeal to high-end consumers, ensuring steady demand and high profitability for wellness-focused resorts.

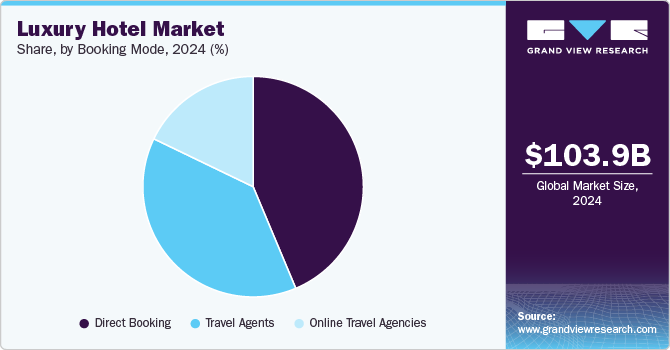

Booking Mode Insights

Booking luxury hotels through the direct booking mode accounted for a revenue share of about 42% in 2024. Direct booking is more popular in the luxury wellness industry because it allows hotels to offer personalized experiences, such as tailored wellness packages and exclusive upgrades, that third-party platforms cannot provide. Affluent travelers prefer direct communication to ensure their specific preferences are met. Direct bookings reduce commission costs, enabling hotels to invest more in enhancing guest experiences.

Booking through online travel agencies (OTAs) is expected to grow at a CAGR of 8.0% from 2025 to 2030. This booking mode provides convenience, a wide range of options, and transparent comparisons, which appeal to tech-savvy travelers. OTAs also invest heavily in marketing and user-friendly platforms, reaching a broader audience, including those discovering luxury wellness for the first time. Their ability to offer bundled deals and loyalty programs further incentivizes bookings, particularly for international travelers seeking comprehensive travel solutions.

Regional Insights

The luxury hotel market in North America accounted for a global revenue share of around 36% in 2024. The industry here is growing due to a strong rebound in travel demand, particularly from high-net-worth individuals (HNWIs) and Millennials seeking premium experiences. The rise in domestic tourism, coupled with a growing preference for unique, personalized stays, has driven increased bookings. In addition, luxury brands are focusing on sustainability and exclusive offerings, further attracting affluent travelers.

U.S. Luxury Hotel Market Trends

The luxury hotel industry in the U.S. held a dominant 85% share of the North American market in 2024. The U.S. luxury hotel industry is dominant due to its diverse offerings and continuous innovation in major cities and emerging hotspots. Urban luxury hotels by global brands like Four Seasons and The Peninsula cater to affluent tourists and business travelers in hubs like New York and Miami. The rise of boutique hotels in cities like Austin and Nashville provides unique, culturally rich experiences for younger travelers. Additionally, brands like Six Senses and Aman Resorts integrate wellness and sustainability, appealing to eco-conscious luxury travelers and driving industry leadership.

Europe Luxury Hotel Market Trends

The luxury hotel industry in Europe accounted for a global revenue share of about 28% in 2024. The market here grows due to the revival of heritage hotels, like Belmond’s Grand Hotel Timeo and Ashford Castle, which combine historical charm with modern luxury. Coastal resorts and villas in destinations such as the French Riviera and the Amalfi Coast are attracting high-net-worth travelers seeking privacy and stunning views. Additionally, Europe's emphasis on culinary excellence, with partnerships between luxury hotels and Michelin-starred chefs, enhances the guest experience, making luxury stays even more enticing and driving the market's expansion.

Asia Pacific Luxury Hotel Market Trends

The luxury hotel industry in Asia Pacific is set to grow at a CAGR of 8.6% from 2025 to 2030. Domestic travel, particularly in China, is surging, where affluent travelers increasingly opt for high-end, culturally immersive experiences. With bookings for four- and five-star hotels up 60% compared to 2019, according to Fliggy’s 2024 Mid-Autumn Festival Travel Forecast, and rising demand for boutique hotels offering localized, authentic stays, such as the Yangshuo Sugar House and Ahn Luh Zhujiajiao, the region is witnessing a shift toward quality-driven, exclusive experiences. As emerging destinations like Jingdezhen and Ngawa grow in popularity, the region’s luxury hospitality sector is well-positioned to cater to evolving traveler desires for both luxury and authenticity.

Key Luxury Hotel Company Insights

The luxury hotel industry is fragmented primarily due to the presence of several globally recognized players as well as regional players. Some prominent companies in this market are Accor, Belmond Management Limited, Four Seasons Hotel Limited, Mandarin Oriental Hotel Group Limited, and Aman Resorts, among others. Market players are differentiating through expansions, investments, and expanding their service offerings to cater to evolving consumer preferences for travel.

Key Luxury Hotel Companies:

The following are the leading companies in the luxury hotel market. These companies collectively hold the largest market share and dictate industry trends.

- Accor

- Belmond Management Limited

- Four Seasons Hotel Limited

- InterContinental Hotel Group

- Mandarin Oriental Hotel Group Limited

- Marriott International, Inc.

- Rosewood Hotel Group

- The Indian Hotel Company Limited

- Radisson Hotel Group

- Aman Resorts

Recent Developments

-

In January 2025, St. Regis Hotels & Resorts opened The St. Regis Aruba Resort in Palm Beach, marking the brand's first presence in Aruba. The resort, designed by Hirsch Bender Associates, featured 252 luxurious guestrooms, including 52 suites. It combined Dutch-Caribbean culture with St. Regis' signature elegance, offering exclusive experiences like the island's first St. Regis casino and a rooftop restaurant by Chef Akira Back. The resort showcased the brand's legacy of refined luxury, enhancing Aruba’s hospitality scene.

-

In January 2025, Mandarin Oriental Hotel Group announced plans to open a new luxury resort and residences in Cabo Rojo, Puerto Rico, set to debut in 2028. The resort, part of the Esencia coastal community developed by Three Rules Capital and Reuben Brothers, will feature 106 rooms and suites, along with private villas, some with plunge pools. The property will offer five dining venues, a beach club, a Spa at Mandarin Oriental, a fitness center, and a Rees Jones-designed golf course. Additional amenities will include a children's club, event spaces, and an outdoor adventure center.

-

In December 2024, Hyatt Hotels & Resorts announced plans to open 50 luxury hotels by 2026, building on a successful 2024. In the past year, the company opened 28 upscale properties, including the Park Hyatt London River Thames and Thompson Palm Springs. Hyatt also acquired Standard International and the curated travel site Mr and Mrs Smith. The new hotels will be divided into two categories: the “Luxury Portfolio” for high-end properties and the “Lifestyle Portfolio” for culture-driven, trendy accommodations. The expansion is part of Hyatt's strategy to capitalize on growing demand in the luxury and lifestyle segments.

-

In June 2023, Bulgari opened its ninth property, and second in Italy, in Rome on June 9, 2025. Located at 10 Piazza Augusto Imperatore, the hotel celebrates the brand's heritage, as its founder, Sotirio Bulgari, established the renowned jeweler nearly 140 years ago in Rome. The 14,000 square-meter building, designed by architect Vittorio Ballio Morpurgo, faces the Mausoleum of Augustus and features a series of restored statues. The interior design by ACPV Architects integrates ancient Roman elements and Italian craftsmanship, including Murano glass lights, Ginori vases, and handcrafted mosaics.

Luxury Hotel Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 110.87 billion |

|

Revenue forecast in 2030 |

USD 156.80 billion |

|

Growth Rate (Revenue) |

CAGR of 7.2% from 2025 to 2030 |

|

Actuals |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Category, booking mode, type, region |

|

Regional scope |

North America, Europe, Asia Pacific, Central & South America, & Middle East & Africa |

|

Country scope |

U.S, Canada, Mexico, UK, Germany, France, Italy, Spain, Japan, China, India, Japan, South Korea, Australia & New Zealand, Brazil, Argentina, South Africa, UAE |

|

Key companies profiled |

Accor; Belmond Management Limited; Four Seasons Hotel Limited; InterContinental Hotel Group; Mandarin Oriental Hotel Group Limited; Marriott International, Inc.; Rosewood Hotel Group; The Indian Hotel Company Limited; Radisson Hotel Group; Aman Resorts |

|

Customization |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Luxury Hotel Market Report Segmentation

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global luxury hotel market report based on category, booking mode, type, and region.

-

Category Outlook (Revenue, USD Billion, 2018 - 2030)

-

Chain

-

Independent

-

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Business Hotels

-

Airport Hotels

-

Holiday Hotels

-

Resorts & Spa

-

Others

-

-

Booking Mode Outlook (Revenue, USD Billion, 2018 - 2030)

-

Direct Booking

-

Travel Agents

-

Online Travel Agencies

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global luxury hotel market size was estimated at USD 103.93 billion in 2024 and is expected to reach USD 110.87 billion in 2025.

b. The global luxury hotel market is expected to grow at a compound annual growth rate of 7.2% from 2025 to 2030 to reach USD 156.80 billion by 2030.

b. North America dominated the luxury hotel market with a share of 36% in 2024. The U.S. accounted for the largest revenue share in that market in 2024 since it is a global financial hub as well as one of the most popular tourist destinations for people across the world.

b. Some key players operating in the luxury hotel market include Accor Hotels, Four Seasons Hotels Limited, Hyatt Corporation, InterContinental Hotels Group, Mandarin Oriental Hotel Group Limited, Marriott International, Inc., Rosewood Hotel Group, Shangri-La International Hotel Management Limited, The Indian Hotels Company Limited, and The Ritz-Carlton Hotel Company, L.L.C.

b. Key factors that are driving the market growth include emerging tourism and corporate industries across various regions, rising disposable income, increasing standard of living of people, and rise in preference for leisure travel.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."